Gold Loan at Branch

Gold Loan at BranchGold Loan at Branch

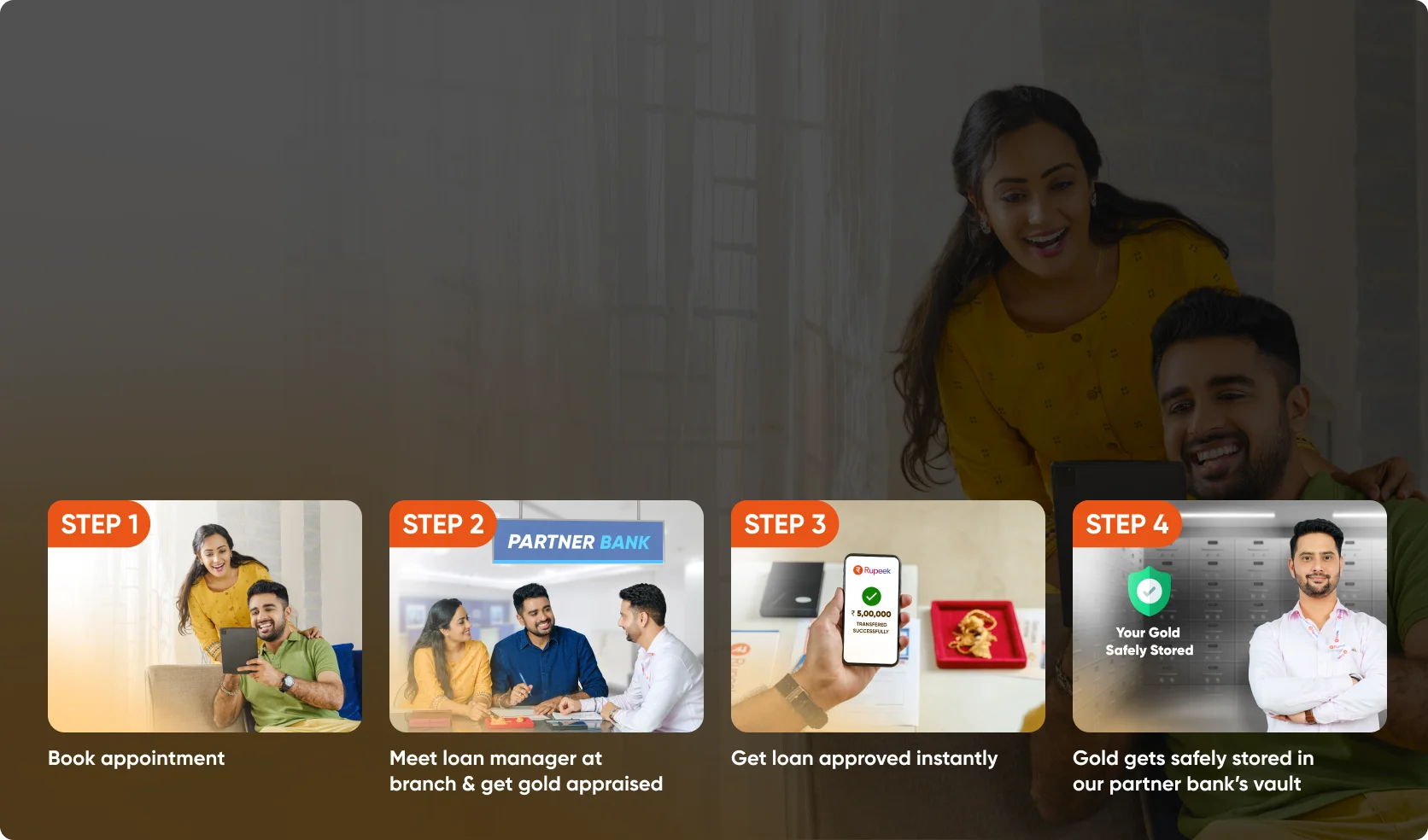

Book Appointment

Select scheme, choose a bank branch, and book a time slot

Meet Loan Manager

Verify loan manager's ID via OTP & get quick gold valuation done, at branch

Get Loan Approved Instantly

Money gets transferred before you leave the partner branch

Secure your Gold

Gold is safely stored in the partner bank's vault

THE NEW INDIA ASSURANCE CO. LTD.

India's Premier Multinational General Insurance Company

Your gold is safely insured throughout the process by India's largest public sector general insurance company.

4.6

17,000+ Reviews

5

4

3

2

1

Madhab Sahoo

(9/3/2026)

Good experience overall. Proper explanation while getting loan, professional executives. Still I was doubtful based upon few reviews but did not experience any such thing. Got proper release, everything was smooth

Samad Khan

(9/3/2026)

This app Rupeek has changed my perception of gold loans. This was the first time ever I got a gold loan and am so grateful for the experience. I downloaded the app and someone got in touch with me for the process. This was an easy experience.

Get Gold loans at low interest rates with 100% safety

Hassle Free Online Repayments

Part Release & Full Release of gold at your fingertips

High Loan Amount for your Gold

How Can we help you today!

General Questions

Applying for a loan with Rupeek

Payment related queries

Others

General questions

What is a gold loan?

A gold loan is a loan in which the borrower offers a certain amount of gold against a loan amount (called loan-to-value or LTV) for a certain period of time. This works like a normal secured loan in which the gold acts as collateral or asset.

How does gold loan work?

What are the benefits of a gold loan?

What purposes can I request a gold loan for?

How are gold loans different from other loans like personal or credit card loan?

What are the things to keep in mind when taking a gold loan?

When taking a gold loan, a borrower should consider the following points before choosing a lender:</br></br>

- Loan-to-Value (LTV): The loan amount being sanctioned for the gold can vary between lenders. A borrower should ensure they are receiving the highest LTV amount for their gold. </br>

- Interest rate: This rate determines how much a borrower will pay for the loan, so the lower, the better. </br>

- Gold security: Without an insurance cover or secure transport of the collateral, there may be certain risks to consider which can result in major losses. </br>

- Additional fees and charges: These can increase a loan amount immensely, so it’s important to look out for a lender that charges the minimum amount for services being provided. </br>

- Repayment schemes: A borrower needs to be able to repay the loan amount based on their monthly budget and financial standing to avoid defaults. Borrowers should look for flexible repayment plans to ensure this is made possible.</br>

Is a CIBIL score required for a gold loan?

What are the documents that I need to submit?

What are the KYC documents required for a gold loan?

For your gold loan application, we will require the following KYC gold loan documents:

- ID proof (any 1 of the following): Aadhaar Card, PAN Card, Voter ID, Passport, Driving License

- Address proof (any 1 of the following): Aadhaar Card, Voter ID, Passport, Driving License

- Utility Bill / Lease Agreement of local address (Phone / Gas / Electricity / Water / Broadband etc) supported by any 1 of the above.

How is the interest rate calculated for gold loans?

How is the market value of gold determined?

Is a gold loan taxable?

Why should I take a gold loan with Rupeek?

How can I raise a complaint related to my loan?

You can reach us for any query/complaint or feedback at:

1800 419 8000

care@rupeek.com

Who can avail Rupeek gold loan?

What happens if I close my loans in the cooling off period?

Is my gold safe with Rupeek?

How can I request for deletion of data collected as part of onboarding process?

How do I know if the executive is authentic?

You can authenticate our executive through the following ways: </br>

- In-app verification: Once the executive reaches your premises, an OTP will be sent to your number which the executive will then enter on his app to verify the match.</br>

- ID Card: The executive will display his identification card issued by Rupeek.</br>

- ID Proof: The executive can display a government ID proof upon request.</br>

Where can I see further information about Rupeek's lender partners?

Rupeek Capital - https://www.rupeekcapital.com

Federal Bank - https://www.federalbank.co.in/gold-loans

How to apply for a gold loan with Rupeek?

Applying for a gold loan with Rupeek can be done in 3 easy steps.

- Request a loan:: Download our app, give us a call, or visit our website.

- Get your gold valued:: Complete the KYC process.

- Get money instantly: The loan amount is instantly transferred to your account.

How do I take a new gold loan from Rupeek?

How does loan approval happen?

Can a family member be present for the appraisal in my place?

Is there a processing fee?

How long will it take for me to get my gold loan?

Do I require a guarantor or introducer for availing a gold loan? Do I need to open an account with a bank?

Does Rupeek offer different schemes for different income groups?

What are the different schemes available?

Can I pledge anything other than gold?

Are all gold items accepted?

Is there any maximum and minimum limit for availing gold loan?

What about the tenure of the loan, lock-in period, and prepayment penalties?

Is there a possibility of damage to the ornaments at the time of appraising?

Can I transfer my loan from my existing lender?

Can I take more than one loan at a time?

Can I increase my loan amount after taking the loan?

Which cities is Rupeek currently operational in?

Rupeek currently operates in over 2000 locations across the following cities and more: Bangalore, Mumbai, Delhi, Chennai, Kolkata, Ahmedabad, Pune, Hyderabad, Surat, Jaipur.

Is there a Rupeek branch which I can visit? How do I find the nearest one?

Whom do I contact for more details?

How do I repay the gold loan?

How do I know the interest payable and other gold loan details?

The details of the loan amount, the weight of the gold, gold pledge date, list of gold jewels, interest payable and closure amount are available on the “Repay your Loan” page. On the page, enter your registered mobile number and sign in with the OTP sent to your number.

What payment methods are available for me?

What happens if the loan amount is not repaid on the due date?

Are there any charges levied for late payment of interest?

Yes, you will be charged a late payment fee if you fail to pay the interest amount on time. Please get in touch with your loan manager to know more.

How do I make an interest payment?

What kind of repayments can I do?

You can complete various types of gold loan repayment, including interest payment, closure payment and part payment. </br>

- Interest payment is the interest you need to pay on your principal amount every month.</br>

- Closure payment is the closure amount you need to pay to release all your jewels.</br>

- Part payment is a payment you can make at any point in time which is more than the interest payable for that month. </br></br>

In order to make repayments towards individual loans, please contact customer support at 18004198000.</br>

Can I partially repay the gold loan amount?

My payment has failed, what do I do?

What do I do if the displayed information regarding my gold loan interest is incorrect?

All information relating to interest payable will be visible only on the “Repay your Loan” page. If you believe the information being shown is incorrect, please contact our support team. For rebate schemes, you will be able to see your base scheme interest (as per the highest interest slab as mentioned in your pledge card) and post-rebate interest amount on the "Repay your Loan" page. The interest is calculated automatically considering the rebate schedule and your repayment history. For any queries regarding your interest, please contact our support team.

Can I do a part release?

How do I make a part payment? What is the process?

How do I close my loan on gold and release my jewels?

- Sign in to the Rupeek app with your registered mobile number and OTP. </br>

- Select the 'Repay your Loan' page from the menu options. </br>

- To close the loan, choose 'Close Loan’ as your payment method. </br>

- The loan closure summary will then be displayed, providing details such as accrued interest, rebate amount (if applicable), and the final payable amount for your online gold loan. </br></br>

If you need a Full or Part release, you can select branches by booking a convenient slot during the release process. For assistance, please don't hesitate to call our customer support at 1800 419 8000, a number also provided on your gold pledge card.

What do I do if I have found a discrepancy in the returned gold?

How do I repledge my existing loan?

Do I need to update the bank in the event of a change in address due to relocation or any other reason?

How do I change my mobile number?

Whom do I contact for more details?

How do I refer my friends/relatives and get a referral bonus?

How does the Loan enhancement process work during my renewals?

You can raise a renewal request from the Rupeek app. Once requested, you will be prompted to pay the requisite amount to initiate the renewal process with the lender partner. In cases where the loan is eligible for loan enhancement, the same will be communicated to the lender partner for processing.

Based on the customer repayment and other checks, the lender partner will carry out the loan renewals and transfer excess amounts to the customer’s registered bank account in case of loan enhancement.

Please note that in case of loan enhancement, the amount shown on the app during the renewal request is indicative. The lender partner will process the repayment as per its systems and transfer the correct loan enhancement amount to the customer’s bank account. Further please note that the lender partner reserves the right to process or reject the request basis its internal policies and checks.

Change city

Change city